Condo Insurance in and around New York

Looking for outstanding condo unitowners insurance in New York?

Cover your home, wisely

Home Is Where Your Heart Is

When looking for the right condo, it's understandable to be focused on details like neighborhood and home layout, but it's also important to make sure that your condo is properly protected. That's where State Farm's Condo Unitowners Insurance comes in.

Looking for outstanding condo unitowners insurance in New York?

Cover your home, wisely

Agent James B Lavelle, At Your Service

You’ll get that and more with State Farm Condo Unitowners Insurance. State Farm has dependable options to keep your largest asset protected. You’ll get coverage options to accommodate your specific needs. Thankfully you won’t have to figure that out on your own. With personal attention and terrific customer service, Agent James B Lavelle can walk you through every step to help develop a policy that secures your condo unit and everything you’ve invested in.

Getting started on an insurance policy for your condo is just a quote away. Get in touch with State Farm agent James B Lavelle's office to explore your options.

Have More Questions About Condo Unitowners Insurance?

Call James B at (212) 687-1699 or visit our FAQ page.

Simple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

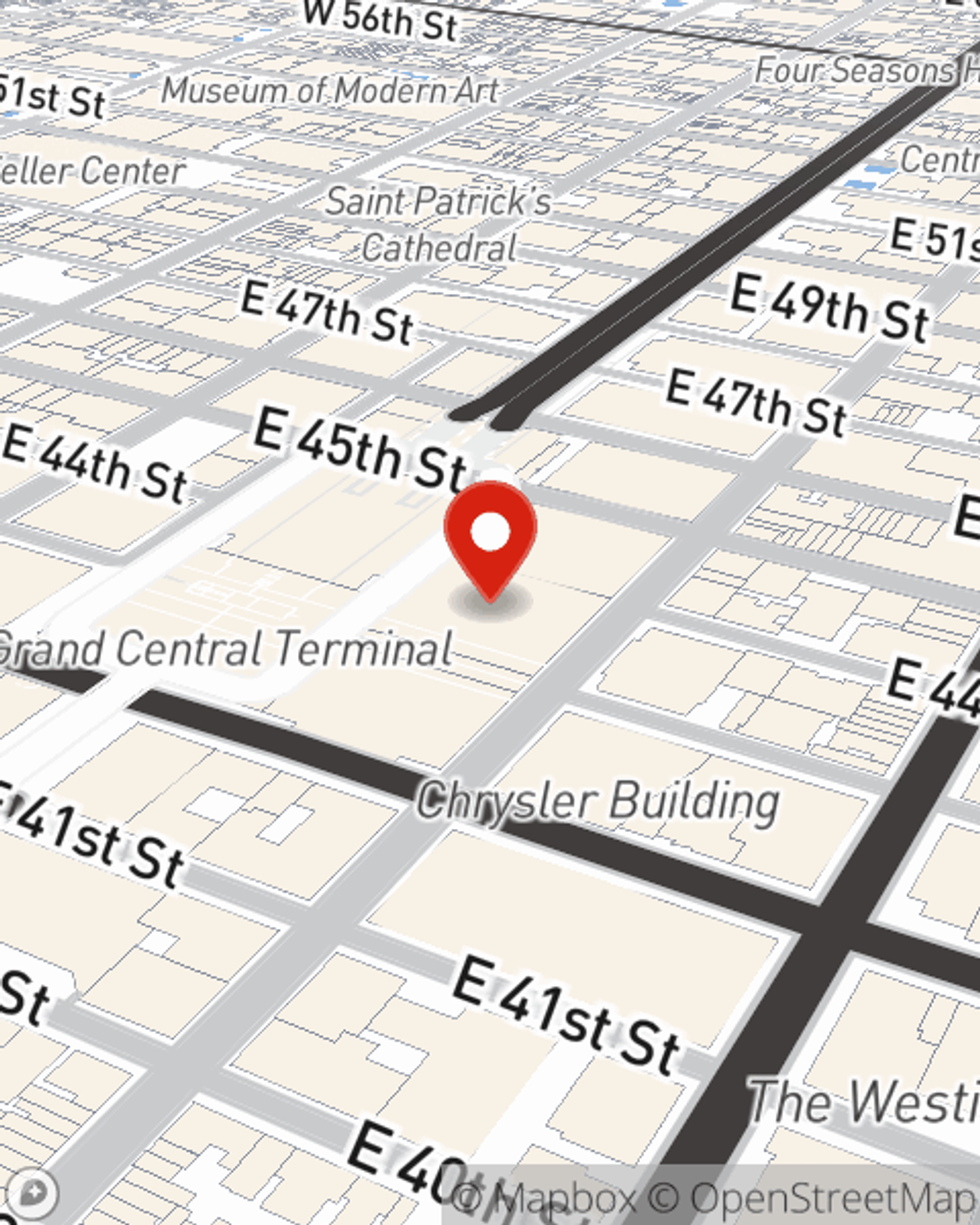

James B Lavelle

State Farm® Insurance AgentSimple Insights®

Insurance issues to consider when hosting a house party

Insurance issues to consider when hosting a house party

Having the right amount of insurance can help protect you when you're hosting a party. Use these tips to make sure you're covered.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.